Assessment Appeals: Getting Your Property Taxes Lowered in Cook County

Did you know that in 2013, 63.05% of appeals to the Cook County Board of Review were successful, and in that same year, of the 53,503 individual (non-parcel) cases filed, nearly 70% received some kind of reduction? Many appeals are successful, and with the right planning and help, yours could be too.

Why Your Assessed Value May Be Overstated

You may be able to appeal your home value based on one of many different arguments including lack of uniformity (property out of line with assessed values of other homes in the area), overvaluation (assessed value higher than market value of similar properties sold in area), or bad information (wrong sq. ft., fire damage, nonexistent building listed, etc.)

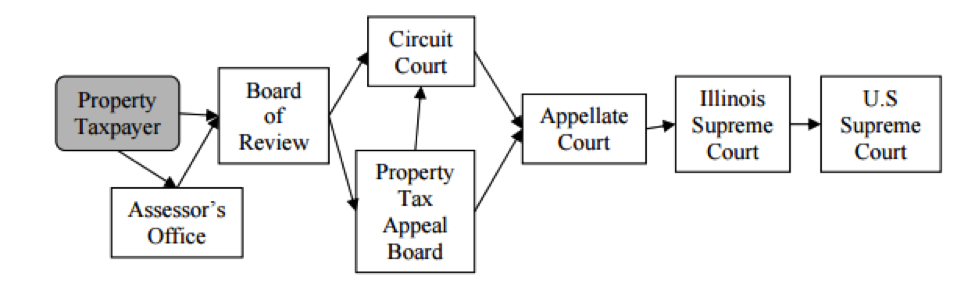

The Five Levels of Property Tax Appeals

There are five levels/avenues of appeal available to you: Cook County Assessor (appeal and re-review), Cook County Board of Review, Cook County Circuit Court, and Illinois Property Tax Appeal Board, with additional options listed in the diagram below.

Forms and Procedures

Below, you will find a very brief overview into the appeal process for the Assessor’s Office, the Board of Review, and the Illinois Property Tax Appeal Board. For a full look into the process, see the Citizen’s Guide to Property Tax Bills.

Assessor’s Office

Appealing to the Assessor requires that the property owner prove that there is a lack of uniformity, an overvaluation, or an error of the property description. When appealing, there are different forms and processes for the varying types of properties, include Residential, Condominium, and Industrial/Commercial/Apartment. Additional forms are required or recommended for commercial/industrial/6+ unit apartments, and buildings owned by not-for-profits.

Board of Review

Appeal

Similar to an appeal to the Assessor’s Office, appealing to the Board of Review requires that the property owner prove that there is a lack of uniformity, an overvaluation, or an error of the property description.

Re-Review

If you are not satisfied with the outcome of the initial appeal, you have the opportunity to file for a “re-review.” A re-review is a chance for mistakes to be corrected, resubmitted, and reconsidered by the Board. Instructions for filing for a re-review can be found on the Cook County Board of Review website.

Illinois Property Tax Appeal Board (PTAB)

The Property Tax Appeal Board (PTAB) is a quasi-judicial body made up of five members and a professional staff, which serves the Board. Following an unsuccessful appeal, you have 30 days to file an appeal with the PTAB. This may be done with or without an attorney, and the two main types of challenges are based on uniformity and/or fair market value.

Appeal Board of Review Decisions to Circuit Court Of Cook County

Instead of going to the Property Tax Appeal Board, taxpayers unsatisfied with decisions by the Board of Review may continue to seek a reduction in their property tax assessments by filing a complaint in the Circuit Court of Cook County. Taxing districts may petition to intervene in such an action, pursuant to provisions of the Illinois Code of Civil Procedure.

Appeal Illinois Property Tax Appeal Board Decisions

There are two options from here. For reductions sought if $300,000 or less, a taxpayer could appeal to Circuit Court. For reductions sought of $300,000+ or to appeal a Circuit Court decision, a taxpayer would go to the Appellate Court. For more information on appealing the PTAB decisions, or any administrative agency’s decisions, see the Illinois State Bar Association article/checklist on the topic.

Conclusion: It Pays to Plan Ahead and Have Legal Representation

The property tax appeal process is a complex, winding battle for property owners, but there are many options available for you to reduce your tax burden. Though the 2016 deadlines for 2015 property taxes have passed, if you are among those expecting to receive an assessment in 2017, it pays to plan ahead.

If you are looking for legal help to lower your assessment, Legal Services Link is here to help. Post your needs and let a real estate lawyer come to you. Learn more at www.legalserviceslink.com, and post your legal needs today!

Do You Need An Attorney?

If so, post a short summary of your legal needs to our site and let attorneys submit applications to fulfill those needs. No time wasted, no hassle, no confusion, no cost.